EITC Refund: Every tax season brings a familiar mix of hope and frustration, especially for low- to moderate-income workers counting on the Earned Income Tax Credit (EITC). For 2026, the refund timeline is once again shaping up to test taxpayers’ patience. Many filers will not see their EITC refunds until March, even if they submit their returns early. While this delay often sparks confusion and concern, there are clear reasons behind it and practical ways to prepare.

Earned Income Tax Credit

The Earned Income Tax Credit is one of the most impactful federal tax credits available. Designed to support working individuals and families with lower incomes, it can significantly reduce the amount of tax owed or result in a sizable refund. For households with children, the EITC can mean several thousand dollars, often making it the largest refund they receive all year.

Because the credit plays such a crucial role in covering essentials like rent, utilities, childcare, or debt repayment, timing matters just as much as the amount. That’s why delays in EITC refunds are felt so deeply by millions of Americans every tax season.

The Key Reason EITC Refunds Are Delayed Until March

The primary reason for the March wait lies in federal law, not IRS inefficiency. Under the Protecting Americans from Tax Hikes (PATH) Act, the IRS is required to hold refunds that include the EITC or the Additional Child Tax Credit (ACTC) until mid-February at the earliest.

This rule was introduced to combat tax fraud and identity theft. Before the PATH Act, fraudulent returns were often processed and paid out before employers had even submitted wage information. By delaying refunds, the IRS gains time to verify income details against W-2s and 1099s, reducing improper payments.

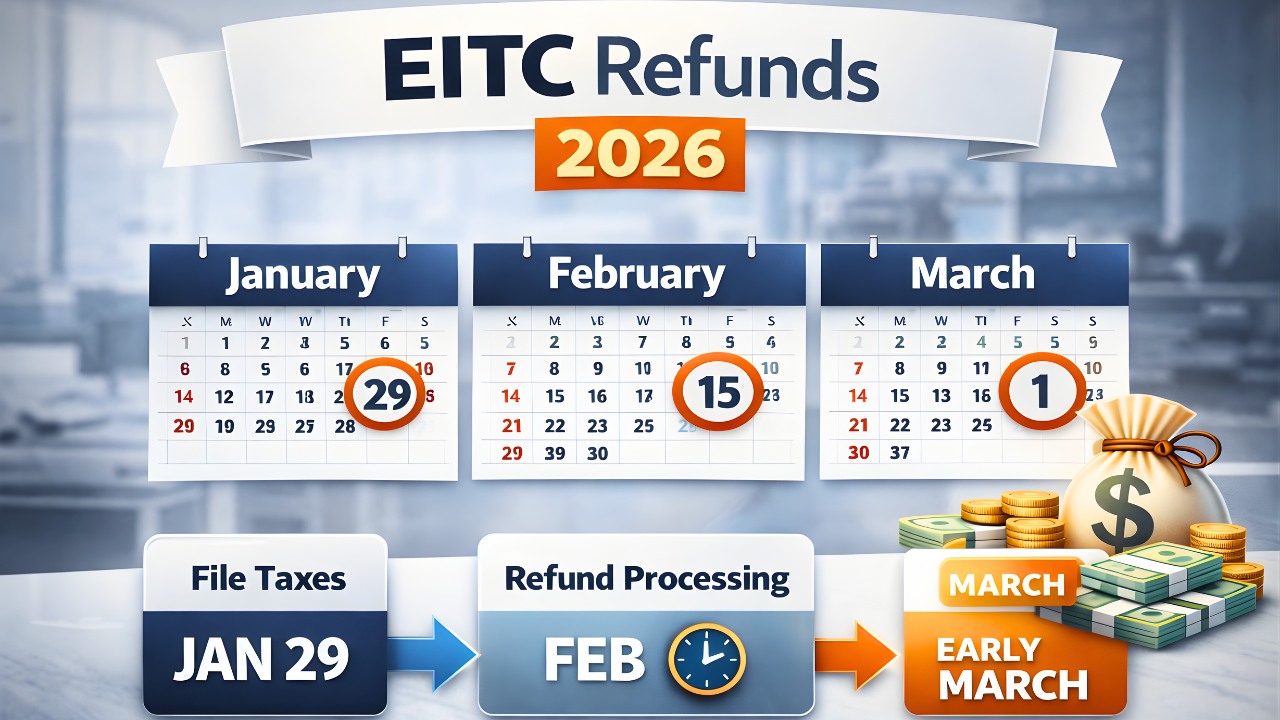

Even though the IRS typically begins processing tax returns in late January, EITC refunds cannot be released immediately. After the mandatory mid-February hold, additional processing time, bank handling, and weekends can easily push deposit dates into early or mid-March.

How the 2026 Timeline Is Likely to Play Out

While the IRS has not released exact dates far in advance, the general pattern for 2026 is predictable based on prior years. Taxpayers who file electronically and claim the EITC as soon as filing opens can expect their returns to be accepted quickly. However, acceptance does not mean payment.

Most EITC refunds are likely to be issued in waves starting in late February, with the majority landing in bank accounts by early to mid-March. Those who file later, choose paper filing, or encounter verification issues may see refunds pushed further into March or even April.

It’s also important to remember that choosing direct deposit significantly speeds things up compared to receiving a paper check, which adds mailing time and potential delays.

Why Filing Early Still Makes Sense

At first glance, filing early may seem pointless if the refund won’t arrive until March anyway. In reality, early filing still offers several advantages.

First, it puts you at the front of the processing line. When refunds are finally released, early filers are usually among the first to be paid. Second, filing early reduces the risk of tax-related identity theft. Scammers often target taxpayers who haven’t yet filed, submitting fraudulent returns in their name to steal refunds.

Finally, early filing gives you more time to resolve issues. If the IRS needs additional information or flags an error, discovering that in February is far less stressful than finding out in April.

Common Issues That Can Push EITC Refunds Even Later

While the PATH Act delay applies to everyone claiming the EITC, some refunds are held even longer due to preventable problems. Errors in reported income, mismatched Social Security numbers, or incorrect filing status can all trigger manual review.

Changes in family circumstances, such as claiming a child for the first time or switching who claims a dependent, also increase scrutiny. Even small mistakes can turn a standard delay into a prolonged one.

Using reputable tax software or a qualified tax preparer can help reduce these risks. Double-checking names, Social Security numbers, and income figures before submitting can make a meaningful difference.

How to Track Your EITC Refund in 2026

The IRS’s “Where’s My Refund?” tool remains the most reliable way to monitor refund status. It updates once per day, usually overnight, and provides three main stages: return received, refund approved, and refund sent.

For EITC filers, the tool may show “received” for several weeks with no apparent movement. This is normal and does not indicate a problem. Once the refund is approved, the deposit date typically follows within a few days, depending on your bank.

Taxpayers should be cautious about relying on refund estimates from tax preparers or software, as these are projections rather than guarantees.

Planning Ahead for the March Wait

Knowing in advance that EITC refunds are unlikely to arrive before March allows for better financial planning. If you depend on your refund for major expenses, building a small buffer or arranging temporary payment plans with creditors can reduce stress.

Some taxpayers consider refund advance products offered by tax preparers. While these can provide early access to funds, they often come with fees or conditions. Weighing the true cost against the benefit is essential before choosing this option.

Bottom Line

The March wait for EITC refunds in 2026 may be frustrating, but it is not arbitrary. It stems from long-standing efforts to protect taxpayers and ensure credits go to those who truly qualify. While the delay can’t be avoided, understanding the timeline helps set realistic expectations.

By filing early, avoiding errors, and planning for a March deposit, taxpayers can navigate the season with fewer surprises. For millions of households, the EITC remains a vital financial boost one that’s worth the wait, even if patience is required every single year.